Attention nonprofit board members and executive directors!

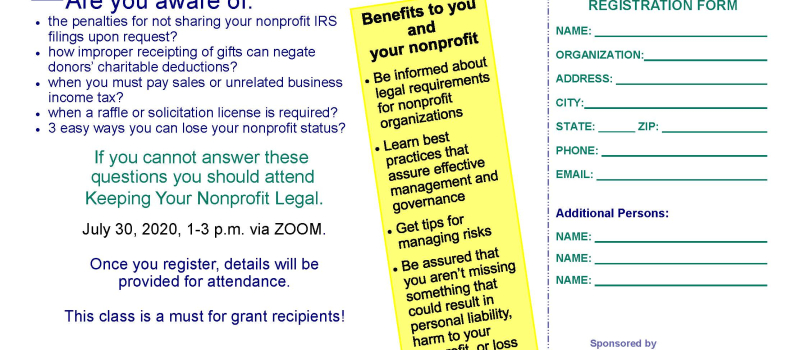

Are you aware of:

- The penalties for not sharing your nonprofit IRS filings upon request?

- How improper receipting of gifts can negate donors’ charitable deductions?

- When you must pay sales or unrelated business income tax?

- When a raffle or solicitation license is required?

- Three easy ways you can lose your nonprofit status?

If you don’t know the answers to these questions you should attend Keeping Your Nonprofit Legal, sponsored by the Lenawee Community Foundation. The workshop will be held on July 30, 2020 from 1-3 p.m. via Zoom. Suann Hammersmith, President & CEO of the Lenawee Community Foundation, will be the presenter in her final workshop prior to her retirement.

Benefits to you and your organization will include:

- Being informed about legal requirements for nonprofit organizations

- Learning best practices that assure effective management and governance

- Getting tips for managing risks

- Being assured that you aren’t missing something that could result in personal liability, harm to your nonprofit, or loss of tax exemption.

There is no cost to attend.

For information or to register contact Paula Trentman through our website or (517) 423-1729. A link for the workshop and the handouts will be emailed to all registered participants.